Experts in Crypto Taxes

With the launch of Bitcoin.Tax, CoinsTax has processed cryptocurrency tax calculations for individuals in the US, Europe and other countries across the world.

In most countries, cryptocurrencies such as Bitcoin, Ethereum and Ripple, are treated as personal property and so subject to capital gains, although specific rules for capital gains treatment and rates can differ in tax jurisdictions.

There are challenges in how individuals, traders, and tax professionals calculate their profits and losses on crypto-currency trading. In the US, each trade must be reported along with any potential gains or losses. Gains and losses are summed and report as capital gains income. In addition, there are reduced rates for long-term gains (owned for more than a year) but it can be difficult to document this if and when audited.

With more than 8 years experience with cryptocurrencies, CoinsTax has deep practical knowledge and expertise in how this all works, how the exchanges report their activity, and how this is combined to create information for use in tax reporting.

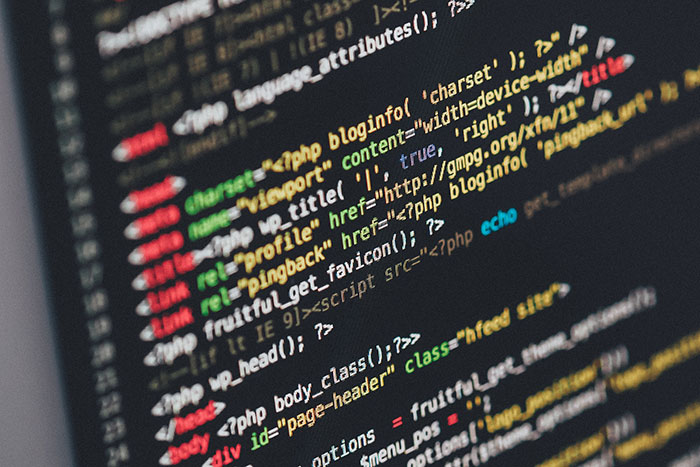

Blockchain Accounting

Automated Tools

Crypto Taxation

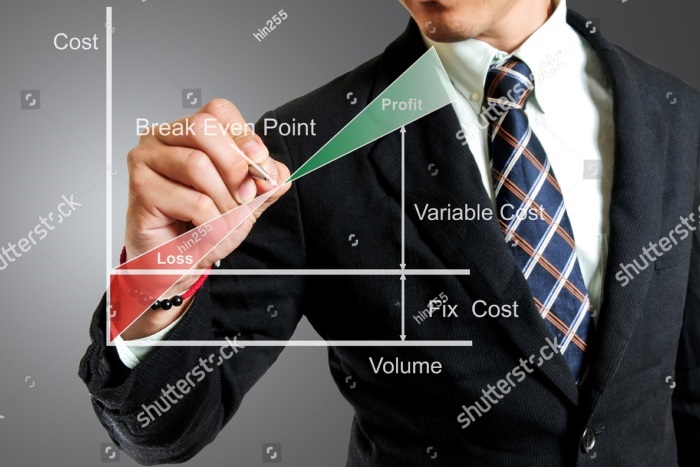

Capital Gains and Income Tax

Data Analysis

Understanding Profit & Loss

Crypto and Blockchain Experts

Services for individuals and tax professionals

Accuracy & Precision

Managing Assets

Open Systems